Recommendation Tips About Is COGS Only For Inventory

Variable Cost Vs Cogs At Earlene Fouche Blog

Unpacking COGS

1. What Exactly is COGS, Anyway?

Alright, let's dive into the world of COGS. No, it's not something you find in a clock tower! COGS stands for Cost of Goods Sold. It's a crucial figure in accounting that represents the direct costs associated with producing the goods a company sells. Think of it as everything it takes to get a product from raw materials to the point where it's ready to be bought.

Now, before you start picturing warehouses overflowing with inventory, let's clear up a common misconception. While inventory is definitely a big part of COGS, it's not the only part. It's like saying pizza is just cheese. Sure, cheese is important, but you need the crust, sauce, and maybe some pepperoni to complete the masterpiece!

COGS is more comprehensive than just the cost of the stuff sitting on your shelves. It's the full story of what it costs to bring your product to life. From the raw materials, to the labor that transforms those materials, to the shipping costs to get them ready for the customer—it all factors in!

So, is COGS only for inventory? The short answer is a resounding no. It's a much broader concept, and understanding that is key to properly managing your business finances. Think of inventory as a subset within the wider COGS umbrella. It's an important ingredient, but not the whole recipe.

COGS Formula 101 Essential Insights For Entrepreneurs

Beyond the Stacks

2. What Else Is Hiding in Your COGS?

So, if COGS isn't just inventory, what else is lurking within this financial figure? Prepare to be surprised! Let's uncover some of the often-overlooked components that contribute to your COGS.

First up: direct labor. This is the cost of the employees who are directly involved in producing your goods. Think of the people on the assembly line, the chefs cooking up your delicious meals, or the seamstresses sewing your fabulous clothing. Their wages, benefits, and payroll taxes all contribute to your COGS.

Next, we have direct materials. This is what you pay for the actual stuff that goes into your product. This is obviously connected to inventory, but it's more detailed than just the value of the finished goods. It includes the price of every single component before its transformed. For example, if you are baking bread, think of the flour, yeast, and water.

And don't forget about manufacturing overhead! This is a bit of a catch-all category that includes all the indirect costs associated with production. Rent for the factory, utilities, depreciation on equipment, and even the salaries of the factory supervisors — all of these are part of COGS. Its all the behind-the-scenes costs that make production possible.

What Is COGS In Business And Accounting?

Service Businesses and COGS

3. COGS for Services? You Bet!

Now, you might be thinking, "Okay, this all makes sense for businesses that sell physical products, but what about service businesses?" Well, the good news is that COGS applies to service businesses, too — it just looks a little different.

Instead of tracking raw materials and factory overhead, service businesses focus on the direct costs associated with providing their services. This might include the cost of materials used to provide the service (think shampoo at a hair salon), the cost of subcontractors, or even the travel expenses incurred while delivering the service.

The key difference is that service businesses don't have inventory in the traditional sense. They're selling their time, expertise, and skills. So, their COGS focuses on the direct costs of those things. Imagine a consulting firm. Their COGS might include the salaries of the consultants directly working on a project, as well as any travel expenses related to that project.

Even digital services have COGS! A software company might include the cost of server space, licensing fees for third-party software, and the salaries of the developers directly involved in creating and maintaining the software in their COGS calculation.

Inventory Accounting Key Terms & Valuation Methods For Retail

Why Understanding COGS is Your Secret Weapon

4. Unlock Financial Insights with COGS

So, why is understanding COGS so important? Because it gives you a crucial insight into the profitability of your business! By accurately tracking your COGS, you can calculate your gross profit, which is the difference between your revenue and your COGS. This tells you how much money you're making before you factor in your operating expenses (like rent, marketing, and administrative costs).

A healthy gross profit margin is essential for covering your operating expenses and generating a net profit. If your COGS is too high, your gross profit margin will be squeezed, leaving you with less money to invest in your business or take home as profit.

By analyzing your COGS, you can identify areas where you can reduce costs and improve your profitability. Maybe you can negotiate better prices with your suppliers, streamline your production process, or find more efficient ways to deliver your services. Understanding your COGS empowers you to make informed decisions that can have a significant impact on your bottom line.

Think of it like this: Knowing your COGS is like having a secret weapon in the battle for profitability. It allows you to see exactly where your money is going and identify opportunities to improve your financial performance.

Why Your Cost Of Goods Sold Is So Very Important DataDrivenInvestor

Calculating COGS

5. The COGS Equation Simplified

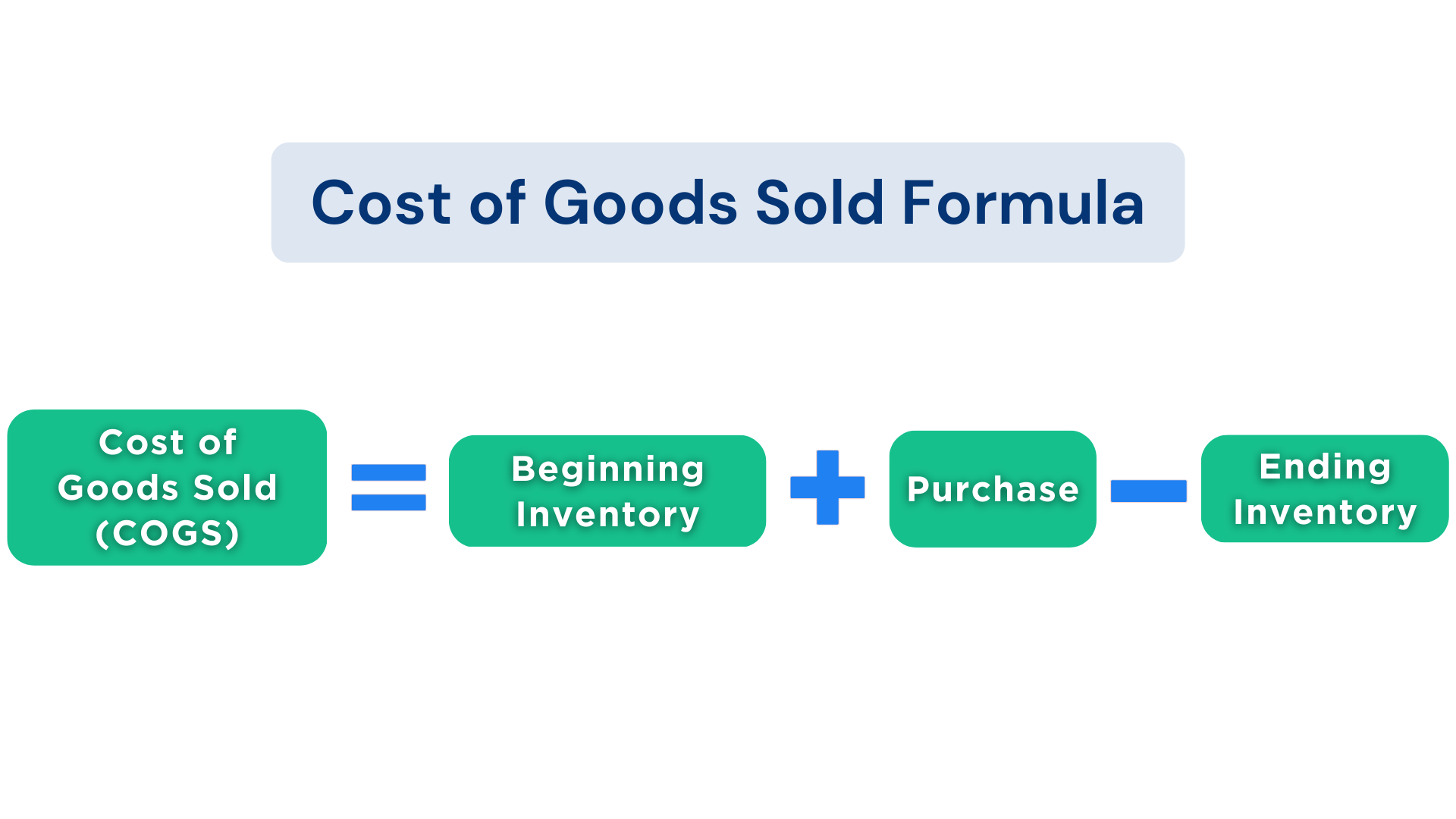

Alright, let's talk about how to actually calculate COGS. Don't worry, it's not rocket science! Here's the basic formula:

Beginning Inventory + Purchases — Ending Inventory = COGS

Let's break that down. Beginning Inventory is the value of your inventory at the start of the accounting period. Purchases are the cost of all the new inventory you bought during the period. Ending Inventory is the value of your inventory at the end of the period.

So, basically, you start with what you had, add what you bought, and then subtract what you have left. The difference is what you sold, and that's your COGS! There are other more complex calculations based on the method your business chooses to determine the cost of their goods. The main thing to know is the direct costs related to the production of the goods you're selling.

Of course, this is a simplified explanation. You may need to adjust this formula depending on your specific business and the types of costs you include in your COGS. But hopefully, this gives you a good starting point for understanding how to calculate this important financial figure. This allows you to monitor fluctuations, and analyze whether they are reasonable, such as large increases in raw material pricing.

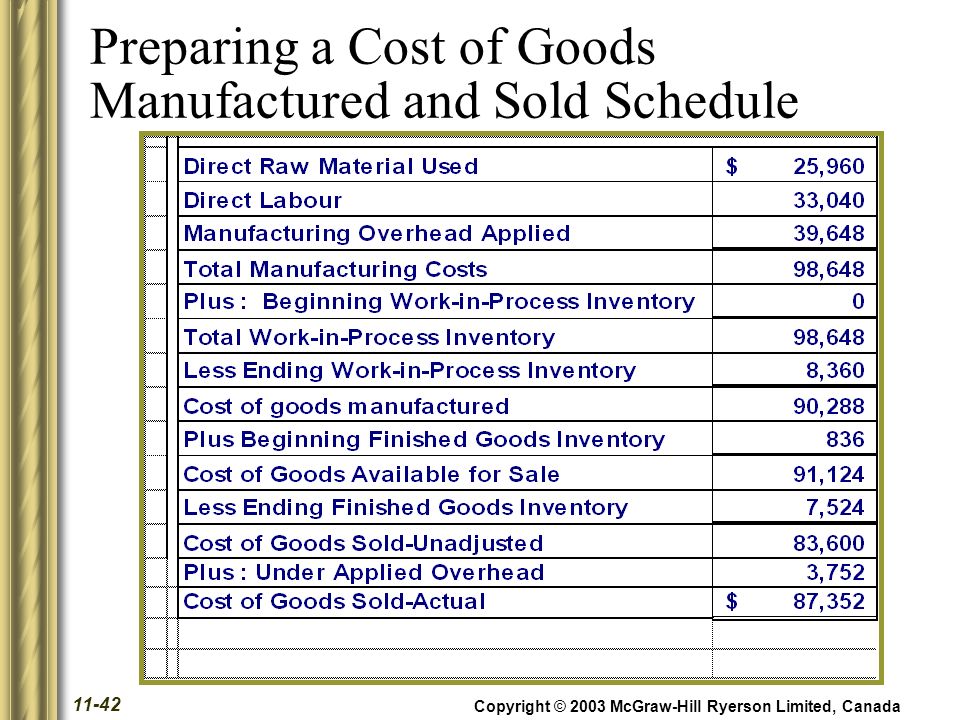

Cost Of Goods Sold Statement

FAQs

6. Frequently Asked Questions About COGS

Q: What happens if I don't track COGS accurately?

A: Inaccurate COGS can lead to a distorted view of your profitability. You might think you're making more money than you actually are, leading to poor business decisions. Plus, it can cause problems with your taxes!Q: Can I deduct COGS on my taxes?

A: Yes, COGS is a deductible expense, which means it can reduce your taxable income. However, it's important to follow the IRS guidelines for calculating and reporting COGS.Q: Does COGS include marketing expenses?

A: No, marketing expenses are considered operating expenses and are not included in COGS. COGS focuses solely on the direct costs of producing goods or services.Q: How often should I calculate COGS?

A: It depends on your business, but most companies calculate COGS on a monthly or quarterly basis. This allows them to track their profitability and identify any potential problems early on.